The debt ceiling issue is critical to the right-wing hardcore minority of Republicans in the House of Representatives, those who agreed to vote for Kevin McCarthy as House Speaker if he would accept their position that the budget must be balanced using the spending side, not the revenue side.

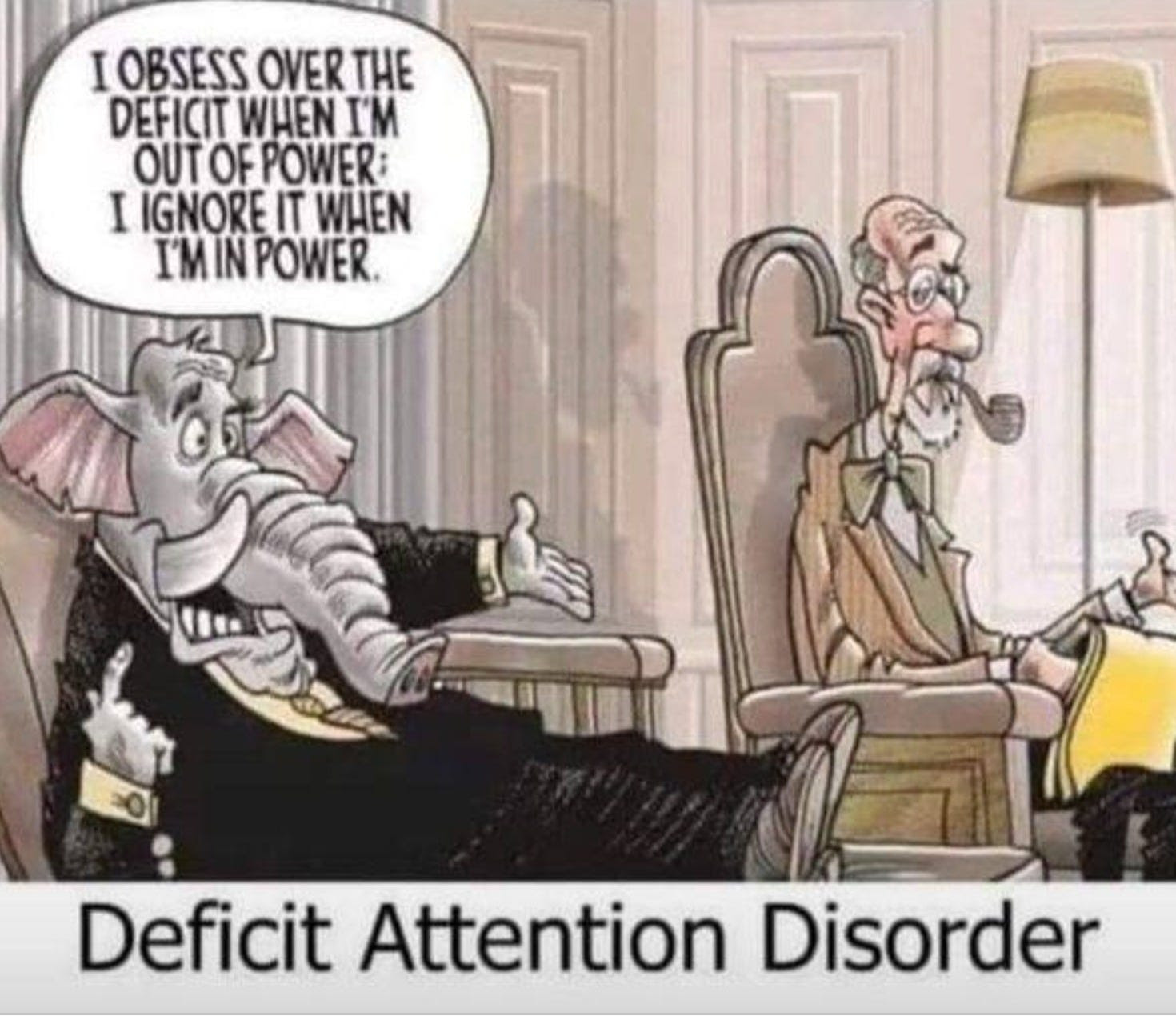

Obstructing the Biden Administration is the game, not the deficit itself. The Congressional statutory debt limit law is usually a formality, as it was when the Trump Administration added billions with a tax cut for the rich. Remember that debt makes banks and institutional investors here and abroad happy. The high earners at these institutions hate paying more personal income tax to eradicate a government expense that benefits them.

Remember that the debt limit applies only to money already spent by Congress. We are watching a mugging at gunpoint in broad daylight with global financial implications and a massive impact on the credibility of the USA.

The Constitution's 14th Amendment explicitly requires that US government debt must be honored, paying bills for money already Congressionally approved and spent. It was adopted after the Civil War when some politicians wanted to renege on loan conditions agreed between banks and the US Treasury.

The budget cap concept was first passed to inhibit American presidents from borrowing to help Allies in World War 1, and again in WW2 to limit American intervention in Europe in the late 1930s as fascism swept Italy and Germany.

The apparent solution to narrow the gap between revenue and expenses is to increase revenue, not cut programs that benefit an overwhelming number of America's 335,000,000 people. The top 10% of earners pay minimal or no taxes relative to their incomes. Less well-off people pay disproportionately high taxes in America through fees, sales, and use taxes. The elephant in the room is extreme income inequality. How big is this elephant? A staggering $50 trillion. That is how much the upward income redistribution has cost American workers over the past several decades.

A paper written by the Rand Corporation states, "If equitable income distributions of the three decades following World War II (1945 through 1974) merely held steady, the aggregate annual income of Americans earning below the 90th percentile would have been $2.5 trillion higher in the year 2018 alone."

That equals nearly 12 percent of GDP—enough to double the median income—enough to pay every working American in the bottom nine deciles an additional $1,144 monthly. Every month. Every single year.

Authors Price and Edwards calculate that the cumulative tab for our four-decade-long experiment in radical inequality had grown to over $47 trillion from 1975 through 2018. At a current pace of about $2.5 trillion annually, that number crossed the $50 trillion mark by early 2020.

That's $50 trillion that would have gone into the paychecks of working Americans had inequality held constant—$50 trillion that would have built a far more extensive and more prosperous economy—$50 trillion that would have enabled the vast majority of Americans to manage the pandemic far more healthy, resilient, and financially secure."

Consider these issues and decide what America you want to grow old in as your grandchildren grow into adulthood.

By: Kenneth Tiven